Musoni

About Musoni

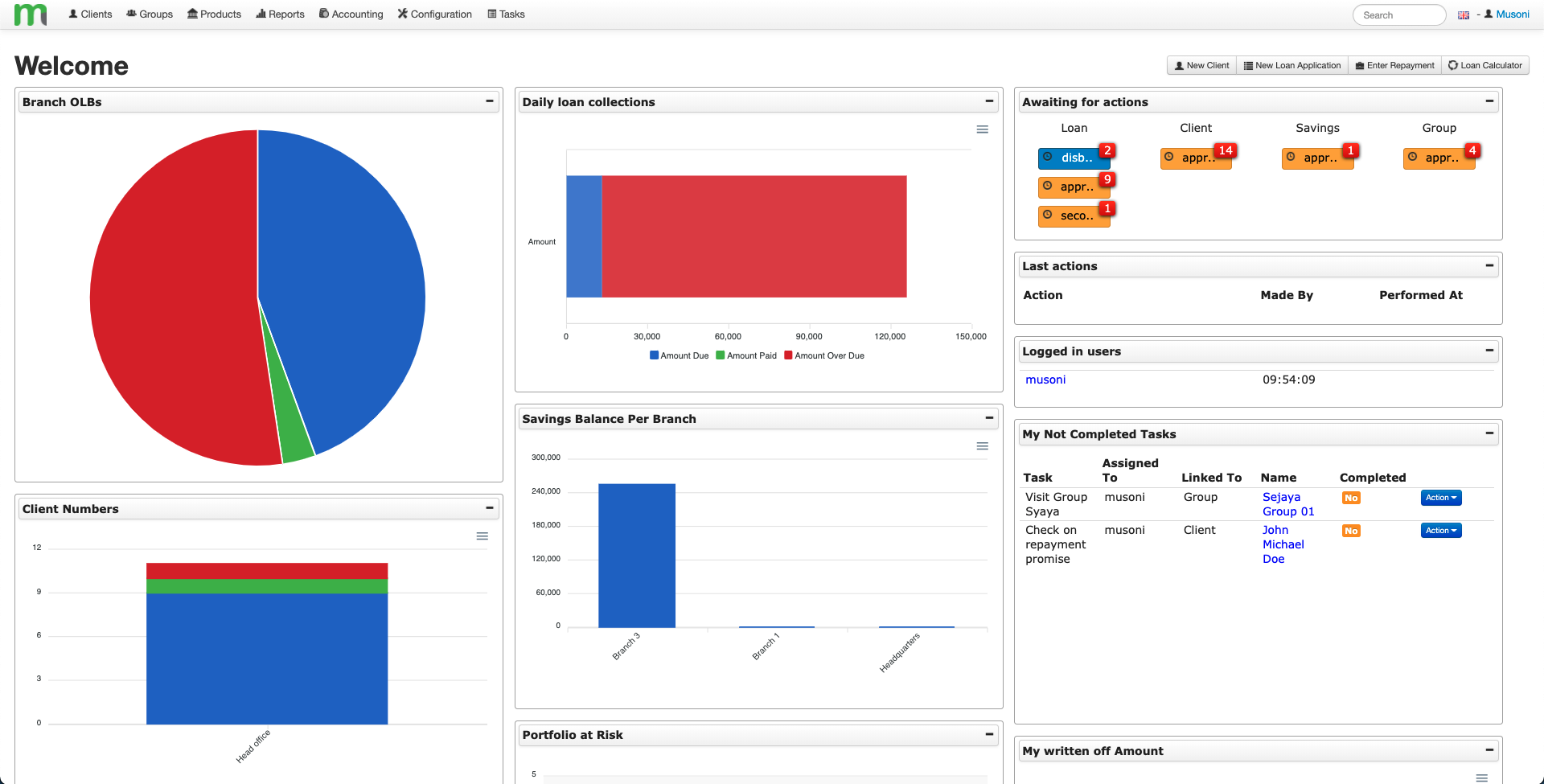

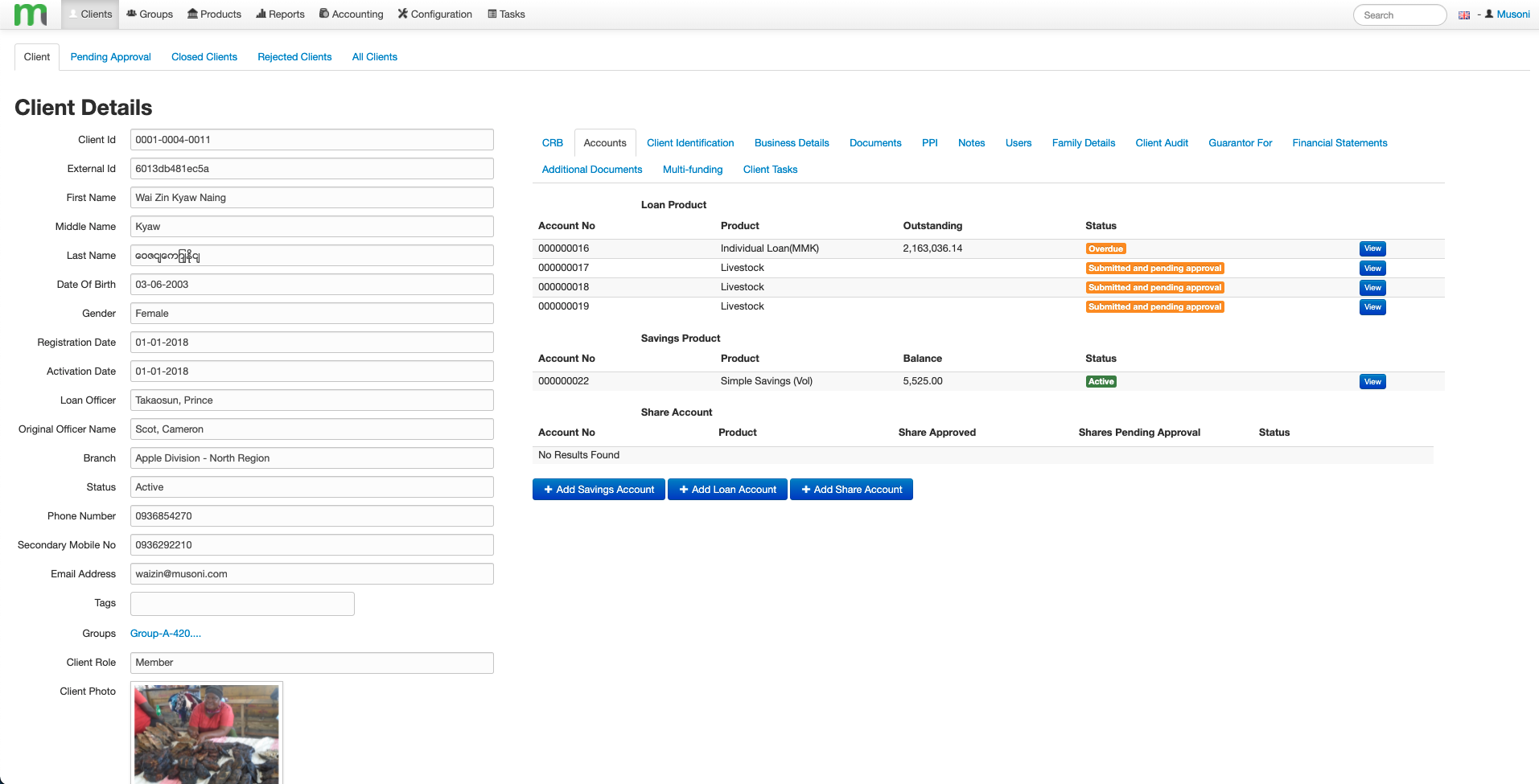

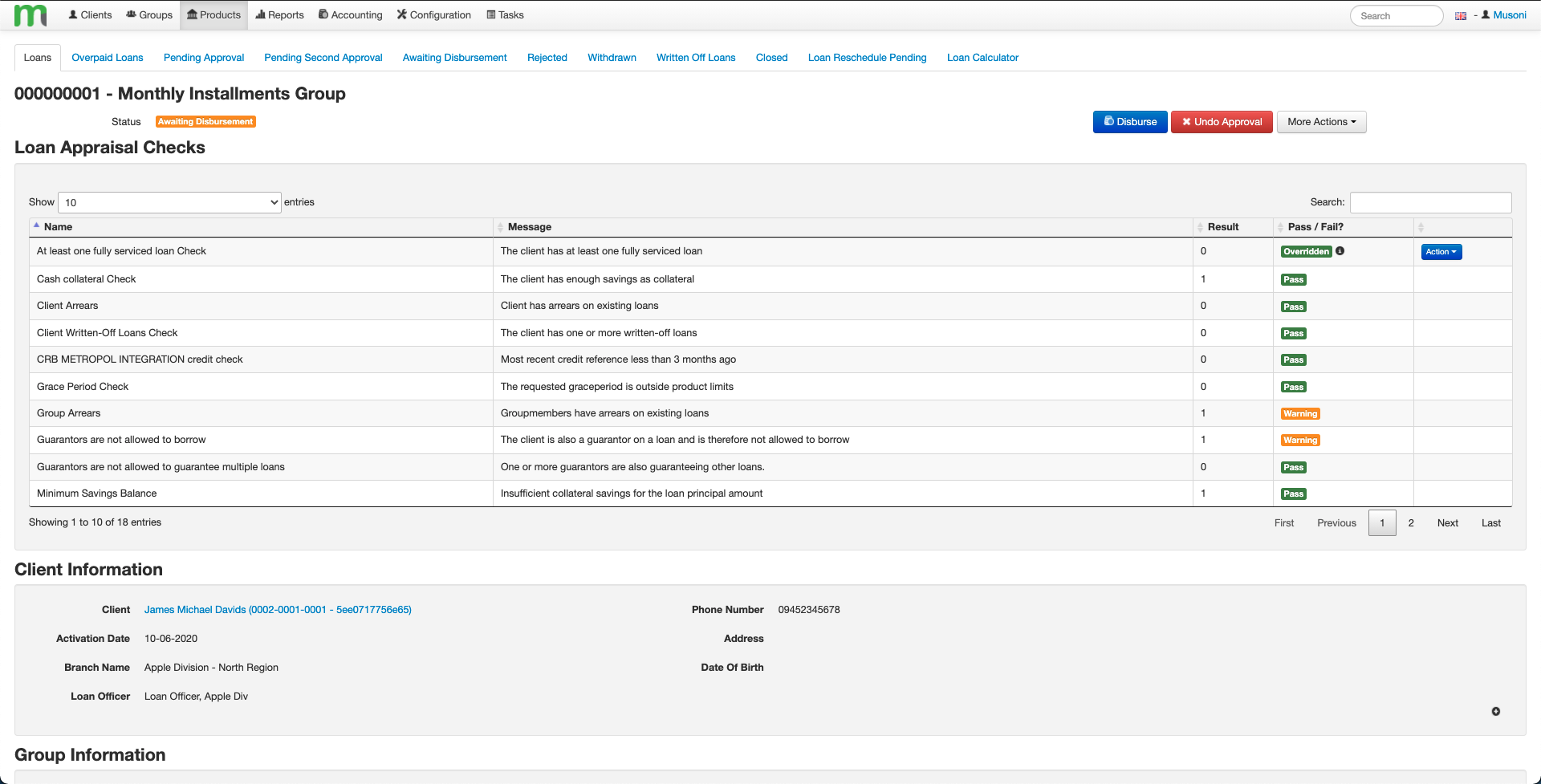

Musoni is the specialist digitalization partner for financial institutions. Musoni enables organizations to create a wide variety of flexible loan, savings, and share products, have fully integrated accounting, multiple digitalization modules, and are built on a secure OpenAPI platform.

Musoni also includes multiple digitalisation tools, including a digital field application for loan officers (online & offline mode), an SMS module for automated and personalised communication with customers, and integration with multiple mobile money providers to enable organisations to digitalise their payments.

Musoni is proud to support organizations across 19 different countries, operating in five languages, and have been proven to help MFIs to efficiently manage & grow their portfolio.

Key benefits of Musoni

Leverage the latest technology

Improve Efficiency

Streamline Operations

Rapidly Grow Client Numbers

Clear oversight of portfolio

Reduce software costs

Digitalise Field Operations

Images

Not sure about Musoni?

Compare with a popular alternative

Show more details

Starting Price

Pricing Options

Features

Integrations

Ease of Use

Value for Money

Customer Service

Alternatives

Filter by

Industry

13 Reviews

This service may contain translations provided by google. Google disclaims all warranties related to the translations, express or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose and noninfringement. Gartner's use of this provider is for operational purposes and does not constitute an endorsement of its products or services.

- Industry: Banking

- Company size: 11–50 Employees

- Used Weekly for 2+ years

-

Review Source

Show more details

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 10.0 /10

Intuitive and fast/responsive loan management system for both simple and complex portfolios

Reviewed on 25/7/2021

Musoni is a great, solid and fit-for-purpose system with a knowledgeable and responsive team. SYPO...

Musoni is a great, solid and fit-for-purpose system with a knowledgeable and responsive team. SYPO has been able to serve thousands of clients faster and through innovative (eg, mobile money) products because of the functionality and flexibility provided by Musoni.

Pros

+ Fast interface

+ Option to keep the system simple for simple portfolios, but ability to build out for more complex portfolios

+ Intuitive processes

+ Good customer service and willingness to tailor product for individual customers

+ Decent dashboards and report functionality

+ Great and well-maintained integration with mobile money and telecom providers (eg, seamless processing of mobile money transactions, SMS messaging)

Cons

- Occasional lack of text / info fields on loan and client pages--which instead can only be accessed through report functionality (eg, reason for write-off)

- Occasional outdated reporting functionality (eg, xls format, strange cell merging)

- Limited self-serve loan processing automation (eg, algorithmic loan decisions or recommendations)

Response from Musoni Services

Thank you Duko for the warm feedback. We love working with you in Uganda and have always been impressed by the strength of the team and continued growth of the company. Fantastic that you benefit from the mobile money integrations already in place, and have been able to improve efficiency & reduce risk as a result.

- Industry: Financial Services

- Company size: 11–50 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 10.0 /10

VIRL Financial Services - Zimbabwe

Reviewed on 4/8/2021

Musoni system has enabled VIRL to reach out to the unbanked population in rural Zimbabwe with loans...

Musoni system has enabled VIRL to reach out to the unbanked population in rural Zimbabwe with loans that are transforming lives in rural communities and therefore reducing urban migration.

Pros

Musoni system is flexible and easy to use and this has enabled us the business to onboard clients faster and more importantly ensure that loan repayments are made on time which is a critical path for the business.

Cons

On the financial module, we would like the option of multi currencies.

Response from Musoni Services

Thank you Virginia! It has been a pleasure to support VIRL over the last six years, especially through all the challenges in Zimbabwe. Looking forward to six years more!

- Industry: Financial Services

- Company size: 201–500 Employees

- Used Daily for 1+ year

-

Review Source

Show more details

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 6.0 /10

Musoni Product Review

Reviewed on 13/7/2021

Improved business efficiency; achievement of our digital inclusion goals for clients and staff...

Improved business efficiency; achievement of our digital inclusion goals for clients and staff alike; accurate reporting and data export that meets business needs; etc.

Pros

Using this product at Standard Life Organization has given us the flexibility of managing several loan and savings products to suit our internal processes. The use of the DFA and CFA gives both our staff and clients alike the convenience of carrying out transactions seamlessly.

Cons

The minimal features on the CFA is a serious downside to the extension of digital services to the unbanked.

Response from Musoni Services

Thank you for the positive review, especially on the high quality of customer support.

I am sorry you are frustrated by the minimal functionality on the CFA. The Client Facing Application (CFA) is deliberately meant as an entry level application and designed to be taken over by the organisations using Musoni who can then add their own specific functionality.

- Industry: Financial Services

- Company size: 11–50 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 10.0 /10

Musoni Operationality

Reviewed on 4/8/2021

We have been able to degitalise our loan process and manage all branches even from a financial...

We have been able to degitalise our loan process and manage all branches even from a financial point of view. Musoni has made it easier to track all financial transactions remotely. Musoni has also helped us track the performance of the portfolio and the performance of loan officers.

Pros

Loan Management and processing is the best feature that Musoni has offered our institution. With the aid of Musoni, we have been able to digitalize our loan processes and reduce the time spent on assessment.

Cons

The ability to track loans and introduce internal controls in the system.

Response from Musoni Services

Thanks Faith - it has been a pleasure supporting your organisations digitalisation and I'm pleased that you've seen active benefits in your portfolio management!

- Industry: Financial Services

- Company size: 51–200 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 7.0 /10

MUSONI SYSTEM REVIEW BY JITEGEMEA CREDIT

Reviewed on 2/8/2021

I overall experience have been good with Musoni cant complain.

I overall experience have been good with Musoni cant complain.

Pros

That is cloud-based can be accessed from anywhere provided you have internet connection and integration to their custom-made field officer app which make it easier for officers to operate from the field. The client app also makes it easier for the client to be able to access his loan details & saving details as well as apply for loans in real-time. I also like the reports being easy to retrieve or schedule for the management team and not forgetting the easy integration of the various system through their open APIs.

Cons

Lack of 2FA which I believe they are working on with projected implementation first quarter of 2022.

Response from Musoni Services

Thank you Raphael for the positive review. Excellent to hear that Jitegemea has fully achieved all your intended goals, including digitalisation with the SMS module, CRB integration and M-PESA! Pleased to be supporting you :-)

- 1

- 2

Musoni FAQs

Below are some frequently asked questions for Musoni.Q. What type of pricing plans does Musoni offer?

Musoni offers the following pricing plans:

- Starting from: €15,000.00/year

- Pricing model: Subscription

- Free Trial: Available

To make the system accessible to as many MFIs as possible, the Musoni System is licensed using a SAAS pricing model, charging annual, rather than upfront fees; the size of the annual fee is based on the size of the MFI licensing the system.

Q. Who are the typical users of Musoni?

Musoni has the following typical customers:

Self Employed, 2–10, 11–50, 51–200, 201–500, 501–1,000, 1,001–5,000

Q. What languages does Musoni support?

Musoni supports the following languages:

Chinese, English, French, Portuguese, Spanish, Vietnamese

Q. Does Musoni support mobile devices?

Musoni supports the following devices:

Q. What other apps does Musoni integrate with?

Musoni integrates with the following applications:

BankBI, Infobip, TransUnion Collections Management

Q. What level of support does Musoni offer?

Musoni offers the following support options:

Email/Help Desk, Knowledge Base

Related categories

See all software categories found for Musoni.